By Monica Wang, APAC Research Leader, safe city and video surveillance, IHS Markit

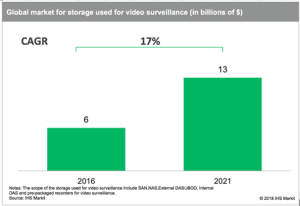

As more large-scale video surveillance projects, such as those for safe cities, are being deployed around the world, information communications technology (ICT) infrastructure is therefore becoming an increasingly important aspect of project implementation. Global revenue from storage equipment, which is a key element of ICT infrastructure, has been growing rapidly. According to the latest “Enterprise and IP Storage used for Video Surveillance Report” by IHS Markit, global revenue from storage used for video surveillance is forecast to grow at a compound annual growth rate of 17 percent, from $6 billion in 2016 to $13 billion in 2021.

Dell EMC, Huawei, NEC, Motorola and other traditional ICT vendors have entered the video surveillance market, either with solutions based on their ICT strengths or through the acquisition of video surveillance companies. At the same time, traditional video surveillance vendors have started to offer ICT products to complement their video surveillance solutions. For example, Hikvision announced its AI Cloud concept at CPSE 2017, and Dahua and NetPosa showcased their video-structuring servers at the same trade show.

New transformational technologies drive the convergence trend

New transformational technologies drive the convergence trend

Deep-learning-based video surveillance analytics promise to generate more metadata that was impossible to generate in the past. Evolving IoT applications with dynamic connected sensors demand faster and more powerful computing platforms. Cloud architectures are being adopted to enable data to be shared more easily and across much larger, more complex networks. All these new transformational technologies are changing not only the video surveillance portfolios, but also the rules of the game.

Convergence leads to new business models

One major implication of this convergence is that traditional video surveillance business models are likely to be influenced by concepts from the ICT industry. For example, an open hardware platform with a related software ecosystem is a typical ICT concept. Huawei is now introducing this concept to the video surveillance industry. In March, the company announced its software-defined camera (SDC) concept, claiming it will enable diversified video analytics algorithms, developed by the independent software vendors (ISV) ecosystem, to run on one camera.

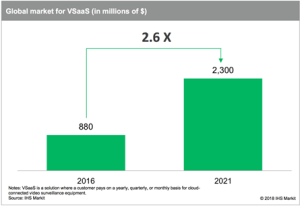

According to Huawei, SDC will decouple the software from its hardware, based on its open operating system, open integration framework and unified algorithm management platform on the cloud. It will be interesting to see whether the SDC model is able to run like a smartphone, with a unified operating system, plus dynamic app ecosystem. However, video surveillance as a service (VSaaS) or video analytics as a service (VAaaS) are two more ongoing examples of ICT changing traditional video surveillance business models. These two technologies offer vendors the possibility of generating regularly recurring revenue, a concept commonly used for ICT.

According to Huawei, SDC will decouple the software from its hardware, based on its open operating system, open integration framework and unified algorithm management platform on the cloud. It will be interesting to see whether the SDC model is able to run like a smartphone, with a unified operating system, plus dynamic app ecosystem. However, video surveillance as a service (VSaaS) or video analytics as a service (VAaaS) are two more ongoing examples of ICT changing traditional video surveillance business models. These two technologies offer vendors the possibility of generating regularly recurring revenue, a concept commonly used for ICT.

The bottom line

The video surveillance market is becoming increasingly intertwined with other industries. Where there were once dedicated security distributors and integrators, now there are ICT and telecoms suppliers competing for business. Where there was once traditional analog cabling between devices, now there is advanced ICT infrastructure integrating numerous IoT devices across the network. Fundamentally, companies embracing emerging technologies, and developing leading infrastructure and networking skill sets, will be well placed to win business, as ICT infrastructure and concepts play an increasingly important role in video surveillance systems.