New research from Canalys shows that a record 1.3 million electric vehicles (EVs) were sold in China in 2020. But year-on-year growth was modest at only 8%. In comparison, worldwide sales of EVs rocketed by 39% in 2020, as reported here.

In a new digital report, Electric vehicle outlook: 2021 and beyond, Canalys publishes detailed EV sales data, forecasts and analysis on the global market with a spotlight on key markets, including China.

The Chinese government has been supportive of the transition to EVs, but several changes to EV-related policies and consumer subsidies in recent years disrupted the market and car makers struggled to build sales momentum. “The Chinese EV market in 2020 was all about two vehicles: the made-in-China Tesla Model 3, the market leader in the first half of 2020, and the Hongguang Mini EV from the SGMW joint venture (SAIC, General Motors and Wuling), the market leader in the second half of 2020, which only launched mid-year,” said Chris Jones, Chief Analyst for automotive at Canalys, “If it had not been for the huge success of these two very different EVs, the Chinese EV market would have declined in 2020. Between them, the two models represented one in five of all EVs sold in China.”

The 1.3 million EVs sold in China in 2020 represented 41% of global EV sales, just behind Europe with 42% of global EV sales. China is still far ahead of the US for EV share – in the US, EV sales represented just 2.4% of sales in 2020.

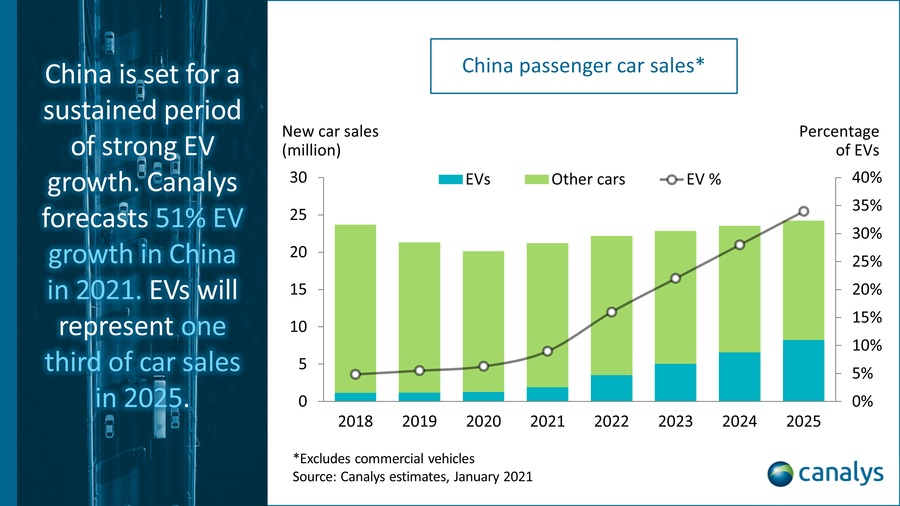

“Prospects are very good for China’s EV market in 2021,” said Jones. “There is already an excellent network of standardized public EV chargers in China, good government support and now a return to strong consumer demand.” Tesla has already started deliveries of the made-in-China Model Y. Production of the Hongguang Mini EV has been increased to keep up with demand, particularly from young Chinese urbanites. Other small, more affordable city cars, such as the Baojun E-Series from SGMW and the Ora R1 from Great Wall Motors (GWM), are also proving very popular. The Ora R1, touted as the world’s cheapest EV, will also soon go on sale in India, where the EV share was less than 0.5% of all cars sold in 2020. Canalys forecasts 1.9 million EVs will be sold in China in 2021, growth of 51% and a 9% share of all cars sold in China.

“With a share of just 6.3% of all passenger cars sold in China in 2020, EVs have many years of growth ahead,” said Sandy Fitzpatrick, VP at Canalys. “But with Tesla expanding its portfolio in China, it will be hard for competitors offering premium EVs to gain market share. With that in mind, some Chinese car makers are already looking for growth opportunities in other parts of the world, especially Europe,” said Fitzpatrick.

China is still the world’s largest car market. 30% of global car sales were in China in 2020, up from 27% in 2019. The overall Chinese car market will return to sales growth in 2021.

Canalys’ Electric vehicle outlook: 2021 and beyond report offers data and insights in an innovative digital format. It will inform the strategies of those in the automotive and technology industries looking to enhance their planning and forecasting. The report is delivered online in an easy-access format, with interactive charts and graphs. It includes:

- The latest market trends.

- Historical and forecast sales.

- Market shares of the leading EV brands.

- New product developments.

- Analysis of the EV charging infrastructure.

- Motorization and urbanization trends.

- Government policies around the world.

Note: EVs include battery electric vehicles and plug-in hybrid electric vehicles. Passenger cars exclude light commercial vehicles.