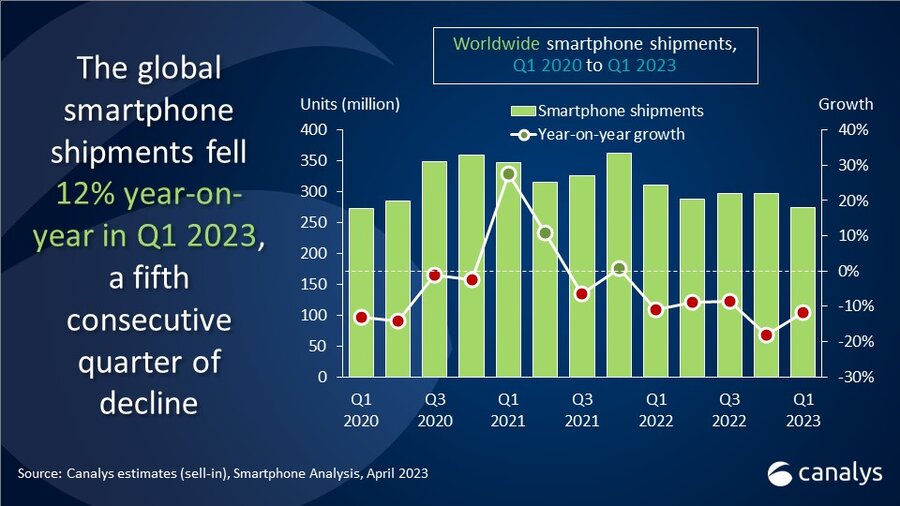

The global smartphone market experienced a fifth consecutive quarter of decline, falling by 12% year-on-year in Q1 2023.

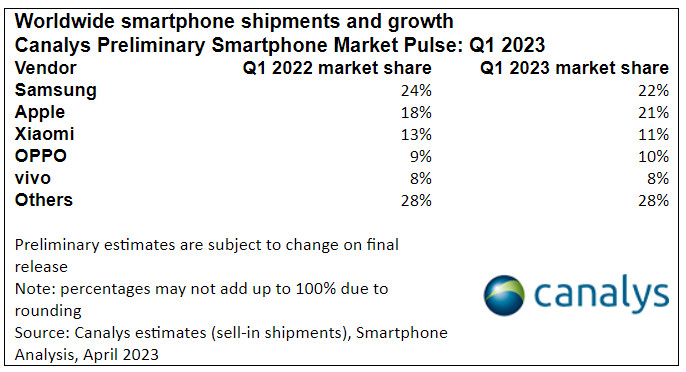

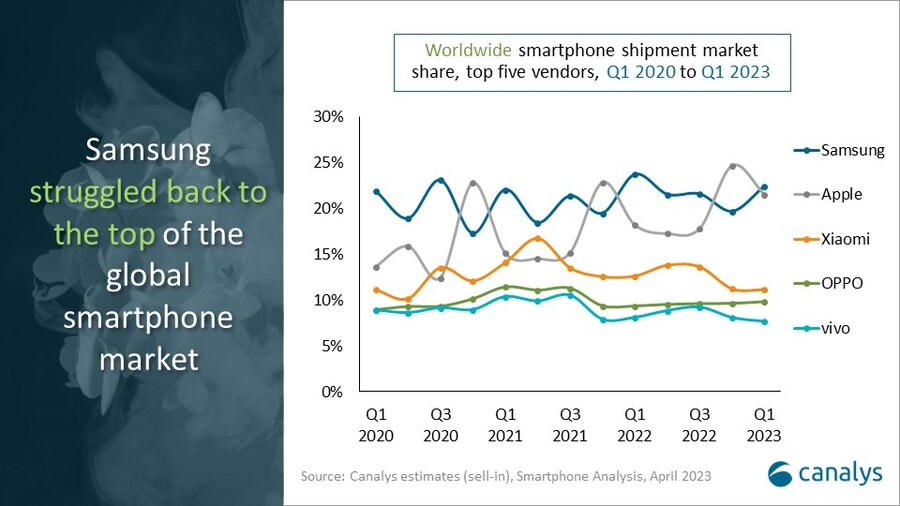

Despite limited improvements in major unfavorable macro factors, the market is yet to recover. Samsung was the only leading vendor to achieve a quarter-on-quarter recovery and struggled back to number one with a 22% market share.

Meanwhile, Apple dropped to second place with a 21% market share, narrowing the gap between itself and Samsung, driven by solid demand for its iPhone 14 Pro series in Q1 2023.

Xiaomi held on to the number three position with an 11% market share, helped by new product launches toward the end of the quarter while inventory adjustment continued.

OPPO and vivo strengthened their positions in the Asia Pacific region and their home markets, accounting for 10% and 8% of the market share respectively.

“The smartphone market’s decline in the first quarter of 2023 was within expectations throughout the industry,” said Canalys Analyst Sanyam Chaurasia. “The local macroeconomic conditions continued to hinder vendors’ investments and operations in several markets. Despite price cuts and heavy promotions from vendors, consumer demand remained sluggish, particularly in the low-end segment due to high inflation affecting consumer confidence and spending. Additionally, the continuous sluggish end-user demand has triggered a major wave of destocking across the entire supply chain, with channels reducing inventory levels to secure operations. To maintain a low level of sell-in volume, vendors continued to use cautious production techniques, which had a long-term negative impact on the component supply chain’s operational performance.”

“However, we have noticed some signs of moderation in the continued decline,” commented Canalys Analyst Toby Zhu. “There have been improvements in demand for certain smartphone products and price bands. Furthermore, some smartphone vendors are becoming more active in production planning and ordering components. Canalys predicts that the inventory of the smartphone industry, irrespective of channel or vendor, can reach a relatively healthy level by the end of the second quarter of 2023. It is still too early to predict the recovery of overall consumer demand. However, the sell-in volume of the global smartphone market is expected to improve due to the reduction in inventories in the next few quarters. In addition, vendors have focused more on innovations and raising production and channel efficiencies after a round of fluctuations, shifting from growing for volumes and shares to growing for quality. 5G popularization and foldable phones are also becoming the new driving forces in the industry.”