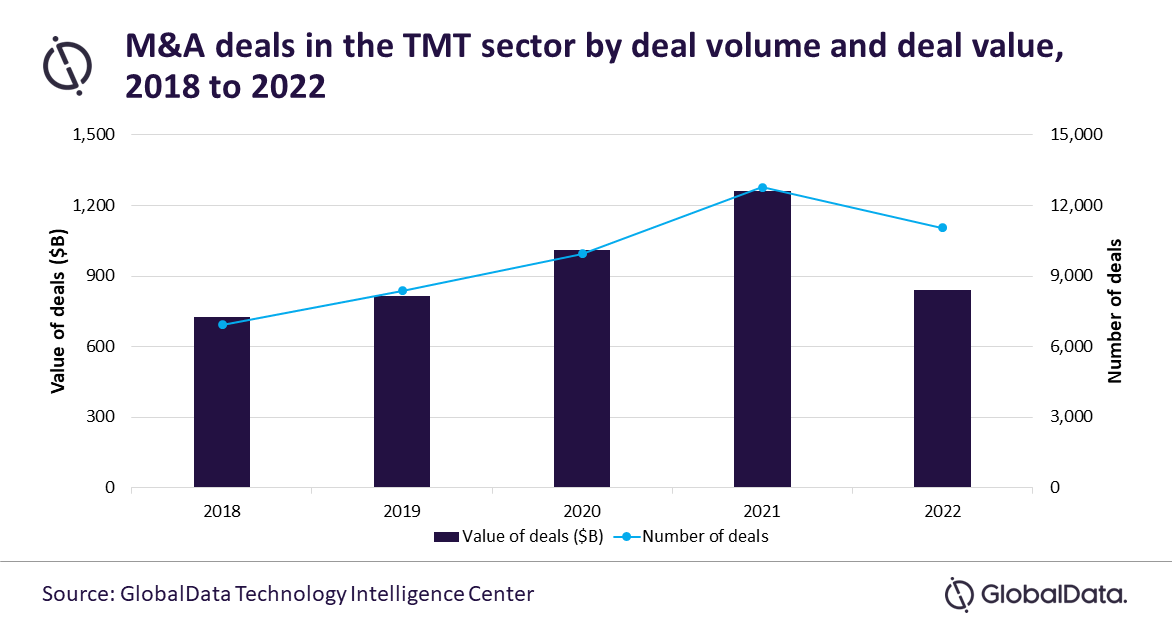

The total mergers and acquisitions (M&A) deals value in the global technology, media, and telecom (TMT) sector during 2022 saw a year-on-year (YoY) nosedive by 33% from $1,261 billion in 2021 to $841 billion in 2022, according to GlobalData.

An analysis by the leading data and analytics company reveals that ‘cloud’ and ‘internet advertising’ were the most important themes driving the 100 highest-value deals in the sector.

GlobalData’s latest report, “Tech, Media and Telecom (TMT) Industry Mergers and Acquisitions Deals by Top Themes in 2022 – Thematic Intelligence,” reveals that the TMT sector M&A market recorded 124 deals with a value greater than or equal to $1 billion in 2022, compared to 269 such deals in 2021.

Priya Toppo, Thematic Intelligence Analyst at GlobalData, comments: “Themes are important factors that will influence the present and future businesses and corporations. Businesses that invest in the right themes will succeed, while those that ignore the important themes fail.

“The ‘cloud’ theme, which is now the dominant model for delivering and maintaining enterprise IT resources, drove $2.1 trillion worth of M&A deal value from the top 100 big deals announced in 2022. Big cloud deals announced in 2022 were Broadcom’s acquisition of Vmware for $69 billion and Evergreen Coast Capital and Vista Equity Partners’ acquisition of Citrix Systems for $16.5 billion.”

Meanwhile, the ‘internet advertising’ theme, which drove $1.2 billion worth of top 100 big deals. Internet advertising is a heavily contested industry, with several tech giants and an array of pure-play vendors competing for market share. The most notable internet advertising deal was the Atoll Bidco’s (Atairos) acquisition of Ocean Outdoor for $580 million. Other big thematic drivers were ‘cybersecurity’, ‘big data’, ‘ecommerce’, ‘digital media’, and ‘social media’.

Toppo concludes: “After a significant increase in both deal value and deal volume in 2021, this year the deal activity sharply fell. The decline was most pronounced in the last quarter of 2022, which saw only 2,384 deals of worth only $94 billion. The TMT sector M&A outlook remains uncertain, with rising interest rates, volatile markets, and an economic slowdown likely to continue to depress the deal activity in the first half of the year.”