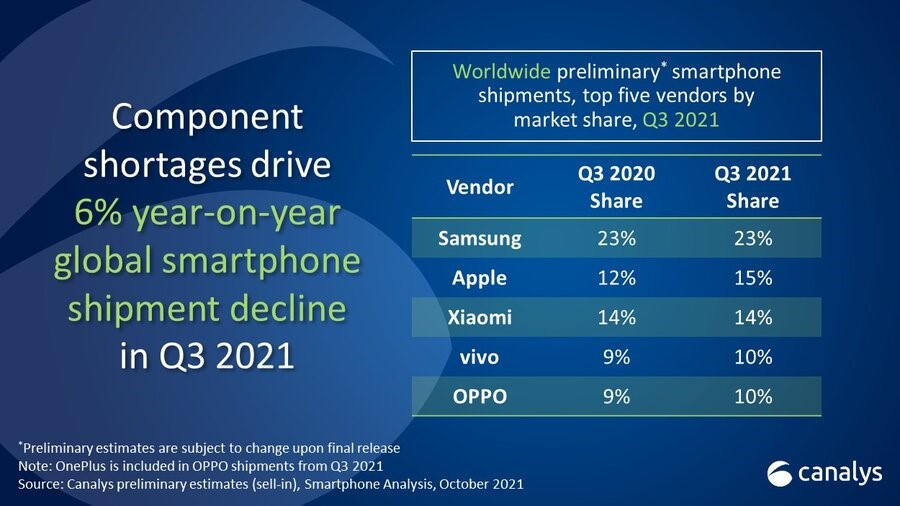

In Q3 2021, global smartphone shipments fell 6%, as vendors struggled to meet demand for devices amid component shortages. Samsung was the leading vendor with 23% share. Apple regained second place with 15% share, thanks to strong early demand for iPhone 13. Xiaomi took 14% share for third place, while vivo and OPPO completed the top five with 10% share each.

“The chipset famine has truly arrived,” said Canalys Principal Analyst, Ben Stanton. “The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply. But despite this, shortages will not ease until well into 2022. As a result of this, as well as high costs of global freight, smartphone brands have reluctantly pushed up device retail pricing.”

“At the local level, smartphone vendors are also having to implement last-minute changes in device specification and order quantities. It is critical for them to do this and maximize volume capacity, but unfortunately it does lead to confusion and inefficiency when communicating with retail and distributor channels,” continued Stanton. “Many channels are nervous heading into important sales holidays, such as Singles’ Day in China, and Black Friday in the west. Channel inventories of smartphones are already running low, and as more customers start to anticipate these sales cycles, the impending wave of demand will be impossible to fulfill. Customers should expect smartphone discounting this year to be less aggressive. But to avoid customer disappointment, smartphone brands which are constrained on margin should look to bundle other devices, such as wearables and IoT, to create good incentives for customers.”

| Worldwide smartphone shipments and growth

Canalys Preliminary Smartphone Market Pulse: Q3 2021 |

||

| Vendor | Q3 2020 shipments

(% share) |

Q3 2021 shipments

(% share) |

| Samsung | 23% | 23% |

| Apple | 12% | 15% |

| Xiaomi | 14% | 14% |

| vivo | 9% | 10% |

| OPPO | 9% | 10% |

| Preliminary estimates are subject to change upon final release.

Note: percentages may not add up to 100% due to rounding Note: OnePlus is included in OPPO shipments from Q3 2021 Source: Canalys estimates (sell-in shipments), Smartphone Analysis, October 2021 |

||