Demand for Electric Vehicles (EV) has continued to grow in 2022, with several new EV models already launched this year. Rising fuel prices have further boosted demand and government incentives help buyers. But supply is still terribly constrained and wait times of many months for delivery are common. While car makers’ order books are healthy today, economic uncertainty around the world will affect new EV orders next year.

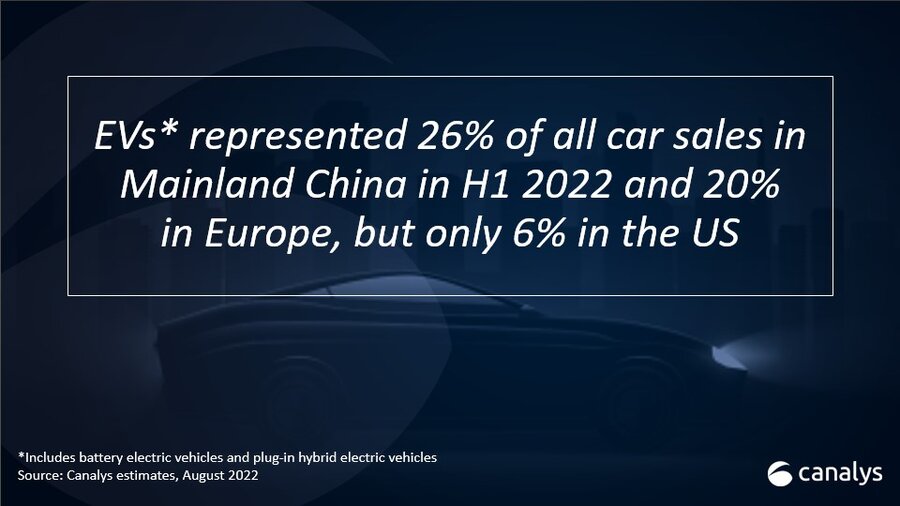

- 2.4 million EVs were delivered to customers in Mainland China in H1 2022. This equated to 26% of all passenger cars delivered there, against just 10% in H1 2021.

- 1.1 million EVs were delivered to customers in Europe, accounting for 20% of all passenger cars. EVs represented 16% in H1 2021.

- In comparison, the US is still catching up. 414,000 EVs were delivered to customers in H1 2022. But EVs grew from 3% of new cars in H1 2021 to 6% of new cars in H1 2022, a rise of 62%.

China is the largest and fastest-growing EV market in the world

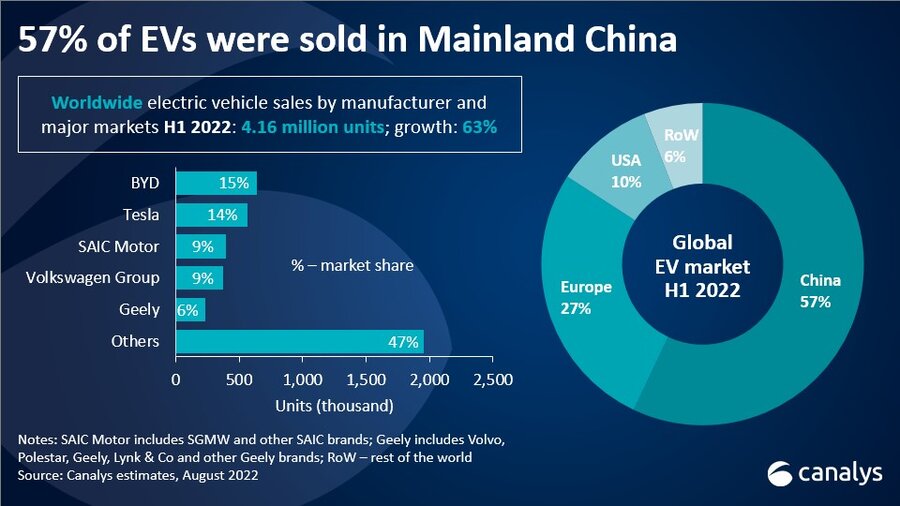

“EV sales in Mainland China more than doubled in H1 2022 and it is now by far the biggest EV market. 57% of global EV sales were in Mainland China. With 118% year-on-year growth, it is the fastest-growing market as well,” said Jason Low, Principal Analyst at Canalys. “26% of new cars sold in H1 2022 in Mainland China were EVs, and more brands and models keep hitting the market. China’s auto industry is showing signs of recovery from supply chain and lockdown challenges, with car companies accelerating production and the government offering tax benefits. With this momentum and strong consumer demand, EV sales should top 5 million by the end of 2022.”

BYD dominates the Mainland Chinese market, accounting for six of the top 10 best-selling EV models (when combining BEV and PHEV models). SAIC is in second place with the Wuling Hongguang Mini EV from its SGMW joint venture still proving popular. Tesla was the third biggest automaker in Mainland China in the first half of 2022. It delivered almost 200,000 vehicles to customers during this period.

Europe faces strained EV supply despite good demand

EV sales in Europe have lost momentum. With big declines in the overall passenger car market across the continent, EV sales managed 9% year-on-year growth in H1 2022. 1.1 million EVs were delivered, which, despite the lower growth rate, still represents an impressive 20% share of all cars delivered, up from 16% in H1 2021. Sales of plug-in hybrids have fallen considerably in 2022 and this trend will continue in favor of BEVs. But a wait time of nine months to a year for the delivery of a new BEV is typical.

“European markets, such as the Nordics, have the highest EV penetration in the world, and might even see signs of market saturation until a new wave of EVs is launched,” said Ashwin Amberkar, Research Analyst at Canalys. “Tesla holds the top two spots in Europe, with the Model Y SUV ahead of the Model 3 sedan. There have been no new EV launches in Europe to get close to the demand for the two Teslas.”

The US is gaining momentum, but more EV models are needed

US EV sales benefited from the launch and first deliveries of electric pick-up trucks in H1 2022. Over 413,000 EVs were sold in the US in H1 2022, including over 64,000 electric pick-up trucks. EV sales grew 62% year on year and represented 6% of all passenger vehicles delivered. The US now accounts for 10% of global EV sales.

“Despite the improved range of vehicle types and EVs from more brands, Tesla still accounted for almost 60% of sales in the US in H1 2022. Popular car brands in the US, such as Chevrolet, Ford, Honda, Jeep, Nissan and Toyota, currently sell very few EV models between them. The sooner this changes, the better, and the US EV share will grow,” said Chris Jones, VP and Chief Analyst at Canalys.

BYD leads in EVs with two other Chinese OEMs in the top five

- BYD is the leading OEM selling EVs. It sold 640,000 EVs (PHEVs and BEVs) in H1 2022 for a 15% market share. It jumped from sixth place to the leadership position with strong sales of models such as the BYD Song Plus, BYD Qin Plus and BYD Han.

- Tesla is the leader in the BEV segment, with a strong performance from its Model Y and Model 3 accounting for 565,000 of vehicles sold during H1 2022, giving it a market share of 14%, up 1% point.

- SAIC Motor, which includes SGMW, the combination of SAIC, GM and Wuling, maintained its third-place position with 393,000 units sold during H1 2022 for a market share of 9%. Wuling is still the leading mini EV provider, selling over 200,000 units.

- Volkswagen Group continues to expand its range gradually. It sold over 375,000 vehicles in H1 2022 for a 9% market share. But it only had one model, the ID.4, in the top 10 list of EV models and needs a new high-volume launch.

- Geely Group includes the brands Volvo, Polestar, Geely, Lynk & Co, Geometry and Zeekr. It took fifth place, selling 121,000 units for a 6% market share in H1 2022.