The total fixed communications services revenue in China is expected to see a sluggish compound average growth rate (CAGR) of 0.5% from $276bn in 2022 to $283bn in 2027, mainly due to drop in average revenue per user (ARPU) levels, according to GlobalData.

GlobalData’s China Fixed Communication Forecast (Q4 2022) reveals that fixed voice and fixed broadband service lines will expand at a CAGR of 0.6% and 1.5%, respectively, over the forecast period. However, both voice telephony and broadband ARPU levels will drop considerably over the forecast period thereby dragging the overall revenue growth in the market.

For Instance, fixed voice ARPU levels in the residential segment is expected to decline from $5.58 to $3.82 between 2022 and 2027 due to the growing popularity of mobile/Internet based communication. Similarly, broadband ARPU levels are expected to decline from $34.56 to $32.01 during the period in residential segment due to the discounted pricing plans offered by operators.

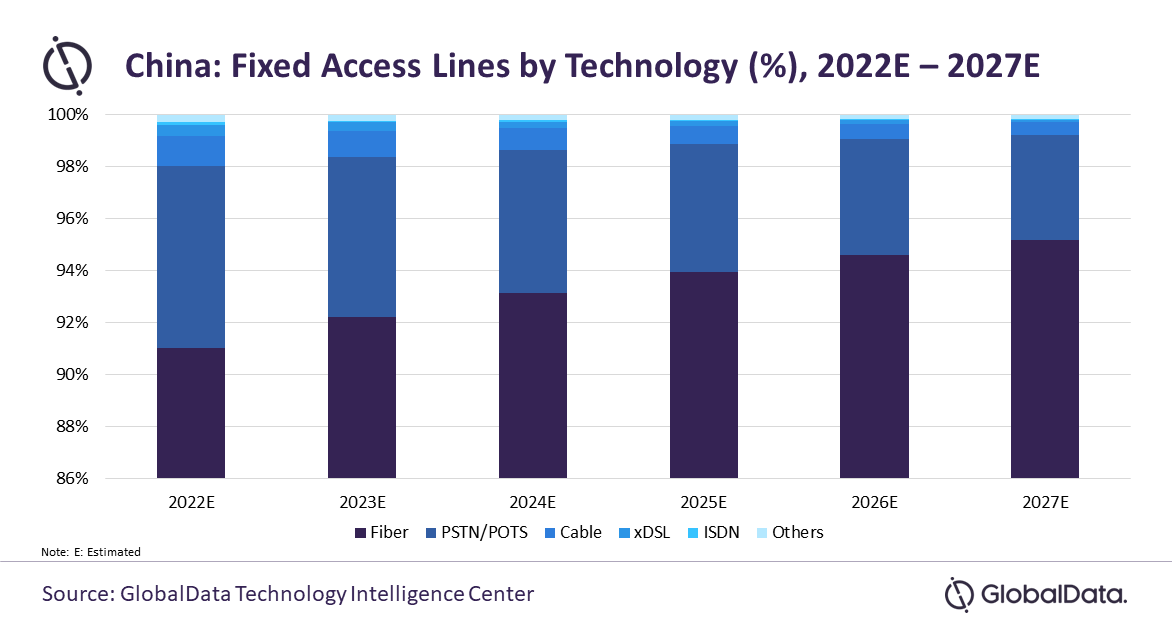

Pradeepthi Kantipudi, Telecom Analyst at GlobalData, says: “Fiber will remain the leading broadband technology in terms of subscription share through the forecast period driven by the government’s support. For instance, the government’s initiative for the implementation of Dual Gigabit Network Coordinated Development Action Plan (2021-2023) aims to improve broadband connectivity and expand fiber-optic networks further in the country.

“China Mobile led the fixed broadband services market in 2022, in terms of subscription share, followed by China Telecom and China Unicom. China Mobile will maintain its leadership in the market through 2027 driven by its strong position in the fiber-to-the-home (FTTH) segment and various promotional discount offers on its broadband and multi-play plans.”