Fixed communications service revenue in Asia-Pacific (APAC) is set to increase at a compound annual growth rate (CAGR) of 1.1% to reach $378.5bn in 2027, supported by the growing fixed broadband service adoption, particularly in the emerging markets of the region, forecasts GlobalData.

An analysis of GlobalData’s APAC Fixed Communications Forecast Pack (Q4 2022) reveals that APAC is a moderately developed region in terms of fixed broadband adoption, with fixed broadband account penetration of population reaching 19.7% at year-end 2022.

By 2027, fixed broadband account penetration of population in the region is expected to reach 21.4%, mainly driven by the ongoing broadband network expansions and service adoption in emerging countries like India, Indonesia, the Philippines, and Thailand, where governments are infusing investments in fixed broadband network infrastructure development plans.

Developed Asia, on the other hand, already has high broadband penetration thanks to the national broadband network (NBN) projects, such as in Australia, New Zealand, and Singapore.

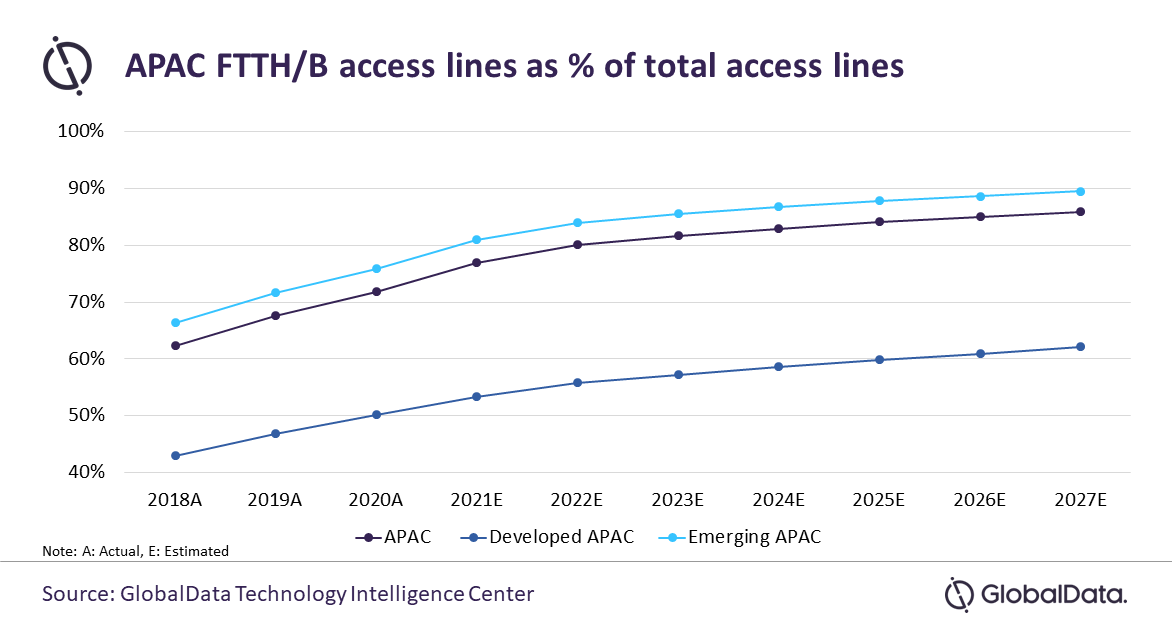

Kantipudi Pradeepthi, Telecom Analyst at GlobalData, says: “The growth in the APAC fixed broadband services market will be led by fiber broadband segment. Fiber-optic access lines will account for a share of about 62% of the total fixed access lines in the developed APAC region by 2027 while its share in the total fixed lines in the emerging APAC markets will be relatively high at 90%.

Rising demand for high-speed internet services and competitively priced fiber broadband plans from operators with benefits like unlimited internet and access to major subscription video on demand (SVoD) platforms will drive the fiber broadband service adoption in the region.

Pradeepthi adds: “In India, for instance, Reliance Jio’s basic broadband plan starts from 399/month that offers truly unlimited data @ 30 mbps speed, while its popular 999/month plan offers truly unlimited data @ 150 mbps with access to 15 OTT platforms, including Amazon Prime Video, Disney + Hot Star, VooT Select, Zee5, and SonyLIV.”

China leads the overall APAC fixed broadband services market with a remarkable 98% of its broadband subscriptions on fiber optic lines as of 2022. The government’s Dual Gigabit Network Coordinated Development Action Plan (2021-2023) aims to expand fiber-optic networks to over 200 million households by the end of 2023.

Similarly, FTTH/B will account for almost 100% of the broadband lines in Singapore by 2027. This is backed by the aggressive approach and investments by the NetLink NBN Trust in fiber broadband network expansions.

Voice telephony penetration of population in APAC, on the other hand, will remain stagnant at around 10% throughout the forecast period. While circuit switched telephony lines will decline at a CAGR of -6.1% over the forecast period, packet switched telephony lines will grow at a CAGR of 4.3%, as various fiber roll-out programs across APAC encourage consumers to switch to VoIP.

Pradeepthi concludes: “Despite the increase in the overall voice telephony access lines in the region, fixed voice revenue will continue to decline over the forecast period on account of the increasing mobile voice and OTT voice usage.”